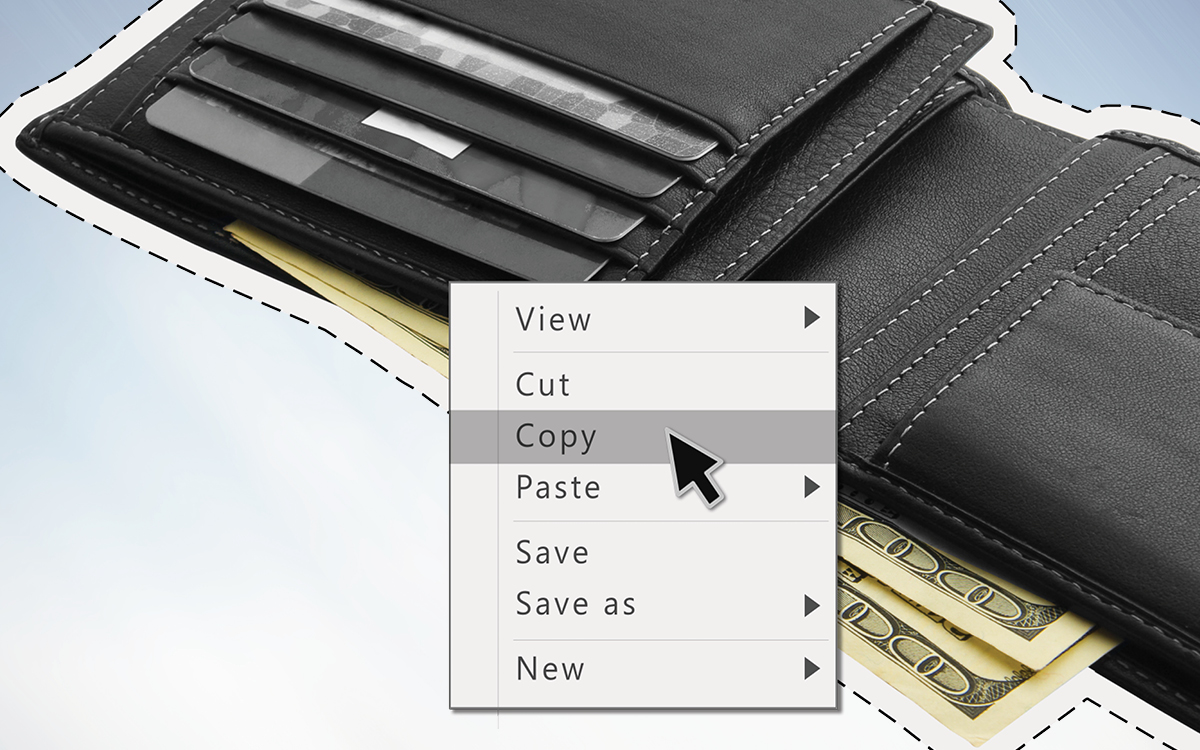

Don’t Be a Victim! Protect Yourself from Identity Theft

By JL Simmerman

re you on someone’s radar right now as a target for identity theft? Would you know if you were? An article published by Consumer Affairs in January 2022 states, “According to the Federal Trade Commission's ‘Consumer Sentinel Network Data Book,’ the most common categories for complaints last year were identity theft, imposter scams (a subset of fraud), online shopping and negative reviews. Government documents or benefits fraud was most prevalent in identity theft cases — more than 406,000 people reported that someone submitted a fraudulent government document under their name.”

Now that more people are working from home, identity theft is a greater threat. From 2019 to 2020, the U.S. experienced a 311 percent increase in victims, with a total payout of $350 million to hackers using ransomware.

Consumer Affairs also advised, “The Identity Theft Resource Center (ITRC) reports that 1,291 breaches occurred in the first three quarters of 2021, breaking the record set in 2017…. Younger adults lose money to fraud more often, but when older people experience a fraud-related financial loss, the median amount is much higher, according to the Federal Trade Commission.”

Louisiana and Texas residents report a lighter number of identity theft cases per 100,000 residents than many other U.S. states, but we still need to be vigilant. There are several things you can do to help reduce your risk of being targeted by identity theft groups.

First, secure your Wi-Fi network and change your passwords often. Don’t purchase from unknown websites or companies online and be wary of which apps you download to your devices. Use trusted apps only. Don’t click links in emails, open attachments from unknown sources, or open links sent to you in Messenger, texts, WhatsApp, or social media ads. Never use an embedded link in an email that asks you to change your account password, provide financial information, or make payments that you did not initiate.

Be especially wary of job postings. Many identity theft groups use bogus job postings to obtain tax and personal identification information from individuals. If you receive a call that threatens legal or financial action against you, take down contact information for the party and then hang up. Verify the validity of claims through legal channels or the police before responding. Never give out personal information in email or on the phone.

Proactively protecting yourself and being aware of the current trends in identity theft attacks can help you keep yourself, your family, and your bank account safe.